Through a strategic partnership, Merge Medical will introduce a member-managed investment vehicle that allows healthcare providers to leverage their collective knowledge. Collaborative Investing creates strength in numbers for Merge Medical forum members. This strategy incorporates decentralized principles and member voting within a low cost, code-driven vehicle that functions within the traditional financial system.

What makes Collaborative Investing transformational?

- You are in control.

- Administered by software at low cost.

- No performance fees fattening the pocket of fund managers.

- Combine capital with your peers, strength in numbers.

- Collective wisdom and knowledge of the group is leveraged.

- Member voting – you pick investments and vote on key decisions.

- An organized community of medical professionals acting collectively as one entity.

- Thematic focus on companies that are understood and whose products or services are of clinical interest.

- This organized community attracts partnerships and quality opportunities.

Where it starts…

Have you ever learned of a great idea, an intriguing story, or a compelling company, but found capital markets to be outside your reach? Let’s explore the factors explaining why physicians are often shut out from the majority of private market opportunities and how this can change.

We believe that it’s possible (and due time) for a community of like-minded individuals to combine capital in a coordinated and advantaged way. Merge Medical is working to bring a decentralized investment vehicle to our community. We feel that Collaborative Investing is the best descriptor for this transformative concept in which the investor is advantaged and no longer passive.

This is not just another version of “Angel Investing”, but an opportunity to use the latest in legal and technological advances to create a vehicle with utmost benefit to the member in terms of fee structure, governance and collaborative involvement. Over time, we expect that this can evolve to tackle some of healthcare’s greatest challenges.

Merge Medical aims to challenge the traditional hierarchy of investing, providing a member-advantaged alternative to the status quo. We are introducing the concept of Collaborative Investing to allow a community of physicians and healthcare providers to leverage their collective knowledge and insight through the vetting of opportunities.

Traditional VC funds charge high fees, and are often limited in their due diligence resources. Could a large community of medical specialists lead to better outcomes?

The due diligence and funding power of a large community, combined with optimal terms and much lower cost, are the foundation of Collaborative Investing.

Understanding the traditional fee structures

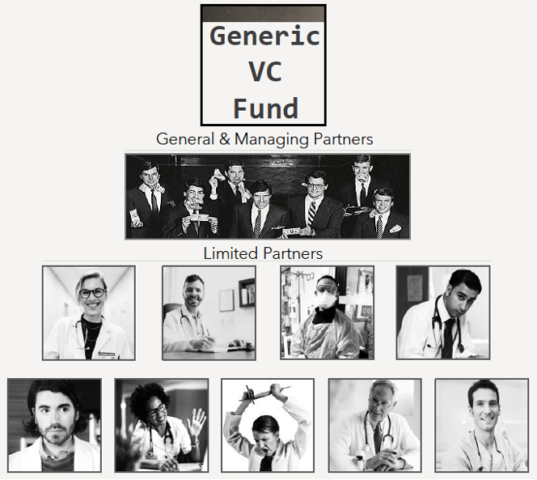

Private market gatekeepers and high minimum investment have long been the primary barriers and status quo of private market access. In the traditional VC fund structure, investors are considered a limited partner (LP) and have a passive role.

Investors pay a significant price to the general partner (GP) for this access. This includes recurring management and compounding performance fees. Most VC firms use a similar fee structure tied to this GP/LP relationship.

Collaborative Investing provides an alternative to this expensive hierarchy. The investor is prioritized and serves as both the LP and the GP.

Your work, your profits, 100%.

With Collaborative Investing, hefty performance fees go away.

Collaborative Investing borrows from the concepts of a DAO (decentralized autonomous organization) and is legally supported by recent DAO LLC laws. It uses community, software, and legal advances to support a process of deal vetting and portfolio creation within a decentralized investment vehicle.

Unlike some companies building financial products on the fringe of legal clarity, the Collaborative Investing SaaS is being built to function within well-defined legal parameters and 100% within the dollar-denominated US banking system. We use traditional payment rails. No cryptocurrency tokens.

A wait list will open soon for participation in the first portfolio and vehicle launch, CI Medical Venture Portfolio (CI MVP1), coordinated by our strategic partner.

Consider promoting your brand and/or sponsoring our website.

Come VC with us!! Join our Forum